Sierra Johnson

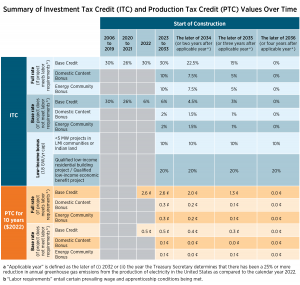

The Inflation Reduction Act (IRA), passed this fall, is the landmark climate bill aimed at curbing inflation by reducing the deficit, lowering healthcare and prescription drug costs, and investing in domestic energy production while incentivizing clean energy. The IRA invests $30 billion in clean energy tax credits to fund decarbonization and accelerate the production of clean energy products. The IRA modifies and extends the investment tax credit (ITC), which historically has supported investment in wind, solar, and other renewable energy infrastructure projects, and creates a “direct pay” cash payment allowing non-taxable entities to monetize these credits. For projects developed in specific communities – including low-income communities and affordable housing – an additional 20% may be available. In addition, the IRA makes these credits available for other zero-emission technologies, such as geothermal and carbon dioxide sequestration.

Tax credit benefits for tax-exempt organizations

Previously, tax-exempt organizations didn’t have the tax liability necessary to utilize the Investment Tax Credit (ITC). In some states, tax-exempt entities could indirectly benefit from federal tax benefits related to solar by entering into complex tax equity financing structures or third-party ownership/power purchase agreements.

With this new legislation, the ITC “direct pay” option will allow tax-exempt entities, such as affordable housing developers, religious entities, rural electric cooperatives, community facilities, municipalities, and tribal governments to receive the benefits of the ITC as an upfront rebate from the Department of the Treasury, in place of claiming the credit on their taxes. The “direct pay” option gives nonprofits the same financial incentives that companies and households with tax liability receive when investing in renewable energy without a complicated financing package or the hassle associated with third-party ownership.

This 30% rebate will allow nonprofits and municipalities to offer cleaner electricity options to communities, notably those subjected to a disproportionate burden of environmental hazards and experiencing a significantly reduced quality of life relative to surrounding or comparative communities.

Additional Tax Benefits for Environmental Justice Communities

In 2021, the EPA released a report showing that socially vulnerable populations are more exposed to the worst impacts of climate change. The IRA directly responds to the report’s conclusions. Under the IRA, investing in low-income communities, tribal nations, or environmental justice communities (i.e., the communities most impacted by environmental harms) could add bonus percentage points to the base ITC and PTC tax credits. Nonprofit organizations in and serving environmental justice communities can claim these additional credits through the “direct pay” option.

The law also provides an additional 10% tax credit for solar and batteries in former fossil fuel regions known as “energy communities,” which the IRA defines as:

- A brownfield site.

- An area where (at any time during the period beginning after December 31, 1999, had) where “0.17 percent or greater direct employment or at least 25 percent of local tax revenues [are] related to the extraction, processing, transport, or storage of coal, oil, or natural gas,” and unemployment is at or above the national average in the previous year.

- A census tract in which after December 31, 1999, a coal mine has closed, or after December 31, 2009, a coal-fired electric generating unit has been retired, or which is directly adjoining to any census tract described in subclause.”

Projects built in these communities can claim this 10% bonus clean energy credit, provided they meet prevailing wage and apprenticeship requirements, aiming to mitigate the adverse economic effects of a decline in fossil fuel activities.

Click to Enlarge. Source.

Three Things Tax-Exempt Organizations Should Know About the Inflation Reduction Act

1. It makes clean energy more affordable to include in your project.

On top of the 30% tax credit, the IRA offers potential bonus credits, including:

- A 10% percent increase (e.g., an additional 10% for a 30% ITC = 40%) if the project is built in an Energy Community, Coal Community, or Brownfield Site;

- A 10% percent increase for projects based in NMTC-qualified low-income communities or Indian land OR an additional 20% percent increase for federally subsidized affordable housing.

For example, suppose a tax-exempt community facility with a $7 million NMTC project in a coal community that includes a $100,000 solar project. In this case, they can earn a 50% rebate and receive a $50,000 check from the US Treasury if it was placed in service on or after January 1, 2023. Forthcoming guidance from the IRS will detail the process for tax-exempt entities to receive direct payment.

2. Are these incentives right for your project?

State, local, and Tribal governments, as well as nonprofit organizations and other tax-exempt entities may elect to receive the following credits as direct payments:

- the Alternative Fuel Refueling Property Credit

- the Production Tax Credit

- the Credit for Carbon Oxide Sequestration

- the Zero-Emission Nuclear Power Production Credit

- the Credit for Production of Clean Hydrogen

- the Credit for Qualified Commercial Clean Vehicles

- the Advanced Manufacturing Production Credit

- the Clean Fuel Production Credit

- the Investment Tax Credit

- the Advanced Energy Project Credit

The construction industry has seen a significant price rise over the past few years, and market conditions will likely worsen before they get better. Our communities cannot afford further delays in critical infrastructure like affordable housing. With all the opportunities within the Inflation Reduction Act, current and future construction projects may see significant monetary benefits and innovative solutions to help mitigate these rising costs.

Find additional policies & incentives that support renewables and energy efficiency: Database of State Incentives for Renewables & Efficiency®

3. How can these credits be paired with other incentives, such as ARPA, NMTC, etc.?

Several types of tax credits and incentives exist at the federal and state level for development projects in low-income communities of all sizes. There are three main federal tax credit programs: New Markets Tax Credits, Low-Income Housing Tax Credits, and Historic Preservation Tax Credits. For tax-exempt organizations, the direct-pay option functions effectively like a grant, making it easy to combine with private and public funding sources.

More questions?

The incentives offered via the IRA will create an opportunity for businesses that, before this legislation, could not invest in sustainable technology in creative or meaningful ways. Get in touch with our team for additional insights.

Disclaimer: This blog post overviews the federal Inflation Reduction Act incentives for clean energy. It does not constitute professional tax advice or other professional financial guidance. It should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.